Now that the Paycheck Protection Program PPP has finally begun we have seen many changes and clarifications issued by banks, the SBA, and an abundance of media coverage as professionals try and figure out how to streamline the process. Many of our clients have contacted us to get reports and tax documents to help in this process. If you need assistance, please don’t hesitate to contact us.

As if you don’t have enough to keep up with, there is more COVID-19 legislation that may impact your company. It is the Families First Coronavirus Response Act (FFCRA) We want to spend time in this post to give you some information you need to know.

On March 18, 2020, the President signed into law the Families First Coronavirus Response Act (FFCRA). This post will provide references and resources for you to read and explore. We are going to identify several key elements that you will be required to know.

If you have an employee that requests leave under this act, Applied Payroll will assist you to implement the proper leave code. We will be able to track the specific leave codes below and assist you with the Tax Credits that will help you offset the cost of this program. Contact our office if you have any employee who is requesting leave due to COVID-19.

1. Who is a covered employer under the EPSLA and EFMLEA?

(Yes, there are TWO parts to this Act you need to distinguish.)

The EPSLA and EFMLEA apply to a private employer if it has fewer than 500 employees. Certain provisions of the FFCRA (the requirement to provide leave due to school closings or child care unavailability) may not apply to employers with fewer than 50 employees that qualify for exemption where leave requirements would jeopardize the viability of the business as a going concern.

2. When do the EPSLA and EFMLEA take effect?

The FFCRA will take effect on April 1, 2020. The EPSLA and EFMLEA will expire on December 31, 2020.

3. What are an employer’s notice requirements under the FFCRA?

Print the poster found in the link below and post immediately.

Employers will be required to provide notice to employees of the Emergency Paid Sick Leave Act. The US DOL’s model notice for federal and non-federal employers is available on the DOL website. Employers will need to post the notice on or before April 1, 2020, when the FFCRA takes effect. If employees are working remotely, the employer should email the poster to employees, post it on the employer’s intranet, if available, and post the notice in all physical facilities.

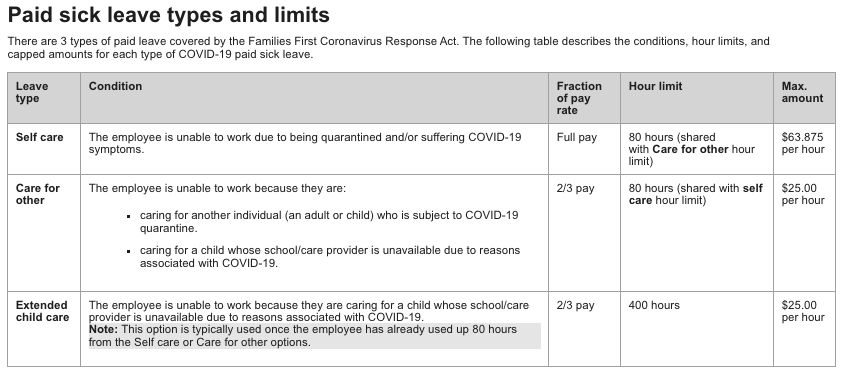

4. What benefits do covered employers have to provide under the Emergency Paid Sick Leave Act (EPSLA)?

The EPSLA allows an eligible employee to take paid sick leave if the employee is unable to work or telework because the employee is:

- subject to a federal, state or local quarantine or isolation order related to COVID-19;

- advised by a health care provider to self-quarantine due to COVID-19 concerns

- experiencing COVID-19 symptoms and seeking medical diagnosis;

- caring for an individual subject to a federal, state or local quarantine or isolation order or advised by a health care provider to self-quarantine due to COVID-19 concerns;

- caring for the employee’s child if the child’s school or place of care is closed or the child’s care provider is unavailable due to public health emergency; or

- experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor.

Under the EPSLA, paid sick leave wages are limited to $511 per day up to $5,110 total per employee for personal use (reasons 1-3 above) and $200 per day or up to $2,000 total to care for others (reasons 4-6 above).

Part-time employees must be provided paid sick time based on the average number of hours worked for the six months prior to taking paid sick leave. If the employee has worked less than six months, they are entitled to the average number of hours they would work over a two-week pay period.

The EFMLA requires employers to pay employees for hours employees would normally have been scheduled to work even if that is more than 40 hours in a week. In other words, if an employee were scheduled to work 50 hours a week, they may take 50 hours of paid sick leave in the first week of leave, but could only take 30 hours in the second week of leave. Pay under EPSLA or EFMLA does not include an overtime premium.

Employers are prohibited from requiring their employees to use other paid leave already provided before an employee uses the EPSLA leave.

EPSLA does not allow for leave to carry over the following year.

5. What benefits do covered employers have to provide under the Emergency Family and Medical Leave Expansion Act (EFMLEA)?

Employees that have worked for their employer for at least 30 days are eligible to take up to 12 weeks of job-protected leave if they are unable to work or telework due to a need for leave to care for their child under the age of 18 if the child’s school or place of care has been closed, or the child care provider is unavailable, due to a public health emergency.

During the first 10 days of EFMLEA, leave may be unpaid; however, the employee may elect to substitute paid leave like vacation or sick leave to cover some or all of the 10 days. An employee can also utilize EPSLA leave during the 10 day period. After the rst 10-day period, employers generally must pay full-time employees two-thirds of their regular rate for the number of hours typically scheduled. The EFMLEA limits pay entitlements to $200 per day or a combined $10,000 per employee.

EFMLEA changes the employer coverage threshold from 50 or more employees to covering all employers with fewer than 500 employees. In addition, the EFMLEA lowers eligibility requirements to allow employees who have worked for the employer for at least 30 days to be eligible for EFMLEA leave.

6. What exemptions or exceptions are available under the EFMLEA?

Under the Emergency Family and Medical Leave Expansion Act, an employer of an employee who is a health care provider or an emergency responder may elect to exclude such employee from the provisions of the EFMLEA. This exclusion does not need to wait for regulations to be issued by the US DOL. It will be available to employers once the law takes effect. For purposes of the EFMLEA, the definition of health care provider is at 29 C.F.R. § 825.125. “Emergency responder” is defined in the FMLA or the FFCRA. We expect it will be in forthcoming regulations.

Also, the Secretary of Labor is authorized to exempt businesses with fewer than 50 employees from the EFMLEA requirements where “the imposition of such requirements would jeopardize the viability of the business as a going concern.” The US DOL will provide emergency guidance and rulemaking to clearly articulate this standard. Until that emergency guidance and rulemaking is issued, all private employers with less than 500 employees should consider themselves a covered employer under EFMLEA.

Employers with fewer than 25 employees are generally excluded from the job restoration requirements if the employee’s position no longer exists following the EFMLEA leave due to an economic downturn or other circumstances caused by a public health emergency during the period of EFMLEA leave. This exclusion is subject to the employer making reasonable attempts to return employee to an equivalent position and requires an employer to make efforts to return the employee to work for up to a year following the employee’s leave.

7. What information has been provided about tax credits available to employers?

Employers will be able to offset payments made under the expanded FMLA provisions and the Emergency Paid Sick Leave Act through offset against their employer portion of Social Security taxes under Section 3111(a) of the Internal Revenue Code, Medicare taxes and federal income taxes. If there are not sufficient payroll taxes to cover the cost of qualified sick and child care paid leave, employers will be able to file a request for an accelerated reimbursement payment from the IRS. The U.S. DOL has issued a release describing how U.S. Department of the Treasury, IRS and the U.S. DOL plan to implement coronavirus-related paid leave for workers and tax credits for small and midsize businesses—further guidance is expected.

Sources: Information gathered from Thomson Reuters, Primmer Piper Eggleston & Cramer web post and the U.S. Department of Labor. For additional information, we recommend you review the resources posted on the Department of Labor website devoted to the COVID-19 and the American Workplace.

Please keep in mind that this situation, like all COVID-19 legislation, is rapidly evolving, and this information is provided to make you aware of this change that may impact your business. This information is intended to provide an overview and is not to be used as legal advice. If you have an employee requesting leave due to COVID-19, please contact our office for assistance.

Additionally, please reference the two below links for fact sheets related to the employee paid leave rights, as well as the employer paid leave requirements:

Families First Coronavirus Response Act: Employee Paid Leave Rights

Families First Coronavirus Response Act: Employer Paid Leave Requirements